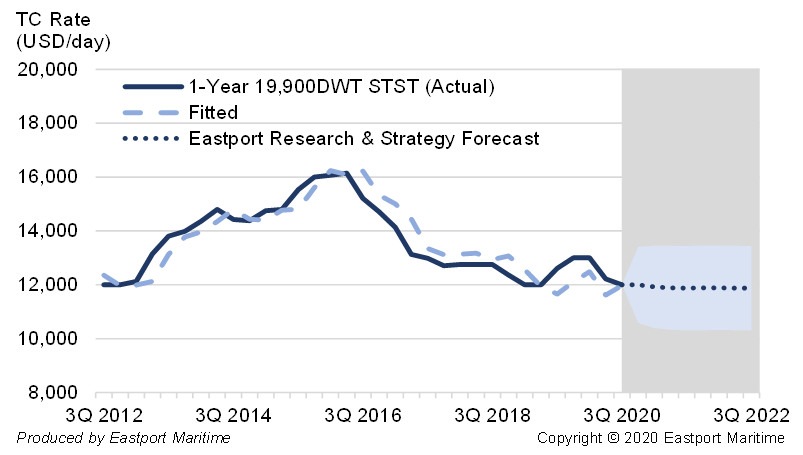

Weak to stable outlook for 19.9kDWT TC rates

19.9kDWT 1-year STST TC rates with Eastport Research & Strategy’s forecasts

These 19.9kDWT tankers can be used on the North-South Asia and SE Asia/India trade lanes. NE Asia exports of liquid chemicals to SE Asia declined 5% YoY in July. Aggregate liquid chemical shipments from SE Asia to the Indian subcontinent gained 21% YoY in July, supported by acetic acid and sulphuric acid volumes. As India gradually eases its lockdowns, demand for feedstock petrochemicals may increase. Imports may also be supported by frontloaded demand ahead of the Diwali festival in November. However, gains are likely to be limited by weakening global demand and trade due to the pandemic. Only 10 vessels are slated for delivery in 2020, down from 14 two months ago. Some owners may choose to postpone the delivery of their tankers as demand is weak amid the pandemic now. Another 24 tankers are scheduled for delivery in 2021, up from 14 two months ago. Eastport Research & Strategy is forecasting TC rates and vessel prices to stay roughly stable in the 19.9kDWT sector. Please refer to Buy Low Sell High: S&P market stable as economies emerge from COVID-19 downturn for TC rate and vessel price forecasts for other sectors.