MR TCE dipped as bunker expenses rose

23 October 2020

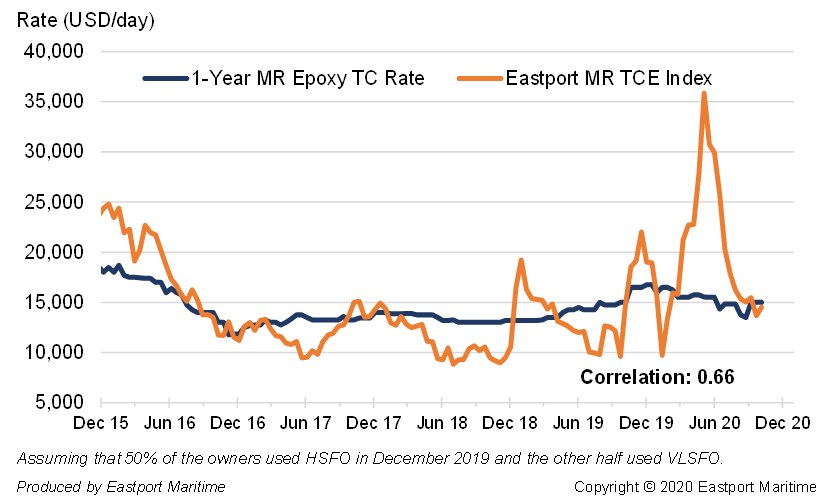

Eastport MR TCE index against surveyed 1Y TC rate

The Eastport MR TCE index measures the theoretical profitability of a 5-year-old 52kDWT chemical/product tanker carrying bulk chemicals on a typical ME Gulf eastbound voyage, and back with palm oil cargos. TCEs soared in Q2 as freights jumped and bunker prices fell. Trends reversed over the summer. MR TCEs dipped 6% MoM in early October. Bunker expenses rose 6% MoM while freights fell about USD 0.50. TCEs may stablize if both costs and revenues fall by the same extent next month. Please refer to October issue of Show Me The Money for more TCE and IRR calculations.