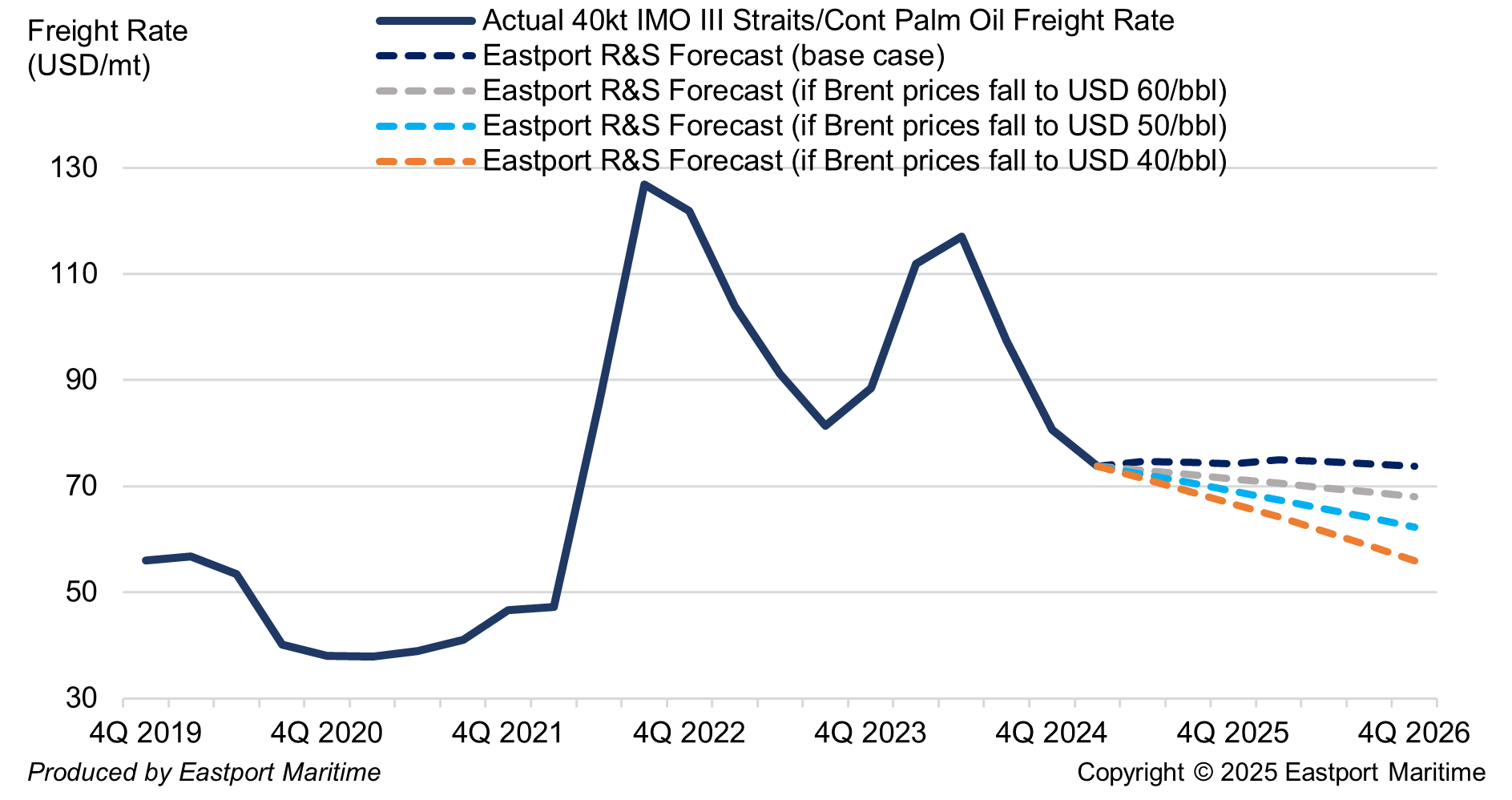

Falling oil prices pose downward risk to palm oil freights

Outlook for 40kt IMO III Straits/Cont palm oil freights under various oil market scenarios

Recent sell-offs on Wall Street are prompting economists to revise downward economic growth projections. Slowing economic growth would likely ease demand for energy products and result in downward pressure on oil prices. Long- haul freights are most sensitive to changes in crude prices because bunker consumption is higher on such routes. Against a backdrop of a widely expected slowdown in global growth, Eastport R&S ran a sensitivity analysis of palm oil freights to assess the impact of different oil price scenarios for freights. The dark blue dotted line is the baseline forecast from end-March, when the Bloomberg consensus forecast was USD 69/bbl in Q3 2026. If Brent crude prices ended 2026 at USD 60/bbl, then Eastport R&S is projecting the 40kt IMO III Straits/Cont palm oil freight rate to fall from USD 74/mt (Q1 2025) to USD 68/mt by end-2026. If a global recession results in oil prices falling to USD 40/bbl by end-2026, then we would expect 40kt Straits/Cont freights to decline to USD 54/mt.