Chinese PX volumes could be supported by PTA projects

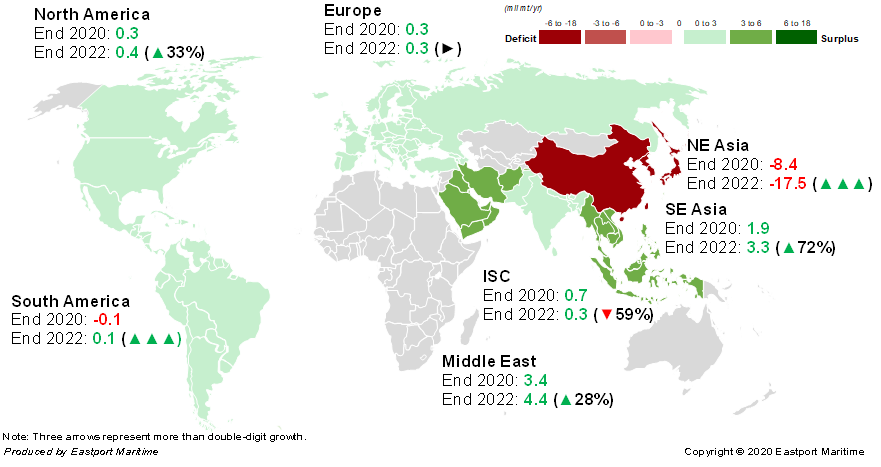

Global PX supply-demand by end 2022 (mil mt/yr)

NE Asia’s deficit in paraxylene (PX) is expected to widen from 8.4mil mt/yr by end 2020 to 17.5mil mt/yr by end 2022 while the other regions are estimated to be in surplus of PX by end 2022, according to Eastport Research & Strategy’s calculation. This is assuming that there are no additional new projects over the next two years and plant start-ups are not delayed. Despite an addition of 13.2mil mt/yr of Chinese PX capacities next year, 19.6mil mt/yr of new purified terepthalic acid (PTA) output, which translates to 13mil mt/yr of PX consumption, would maintain the existing deficit. This may support Chinese demand for PX imports, buoying volumes and freights in the intra-NE Asia trade lane. PX cargos accounted for 45% of aggregate liquid chemical shipments in the intra-NE Asia route in 2019. ISC will see its PX surplus shrinking over the next two years while deficit in South America is expected to turn into a surplus. New PX plants in SE Asia and the Middle East will widen their PX surplus in 2022. For more supply-demand analysis of other bulk chemicals, please refer to Asian Chemical Shipping Annual Review and Outlook for 2021 – A New Dawn.