Global slowdown, oil market downturn raises downside risks for chemical freights

Eastport R&S scenario analysis of oil prices and long-haul chemical freights

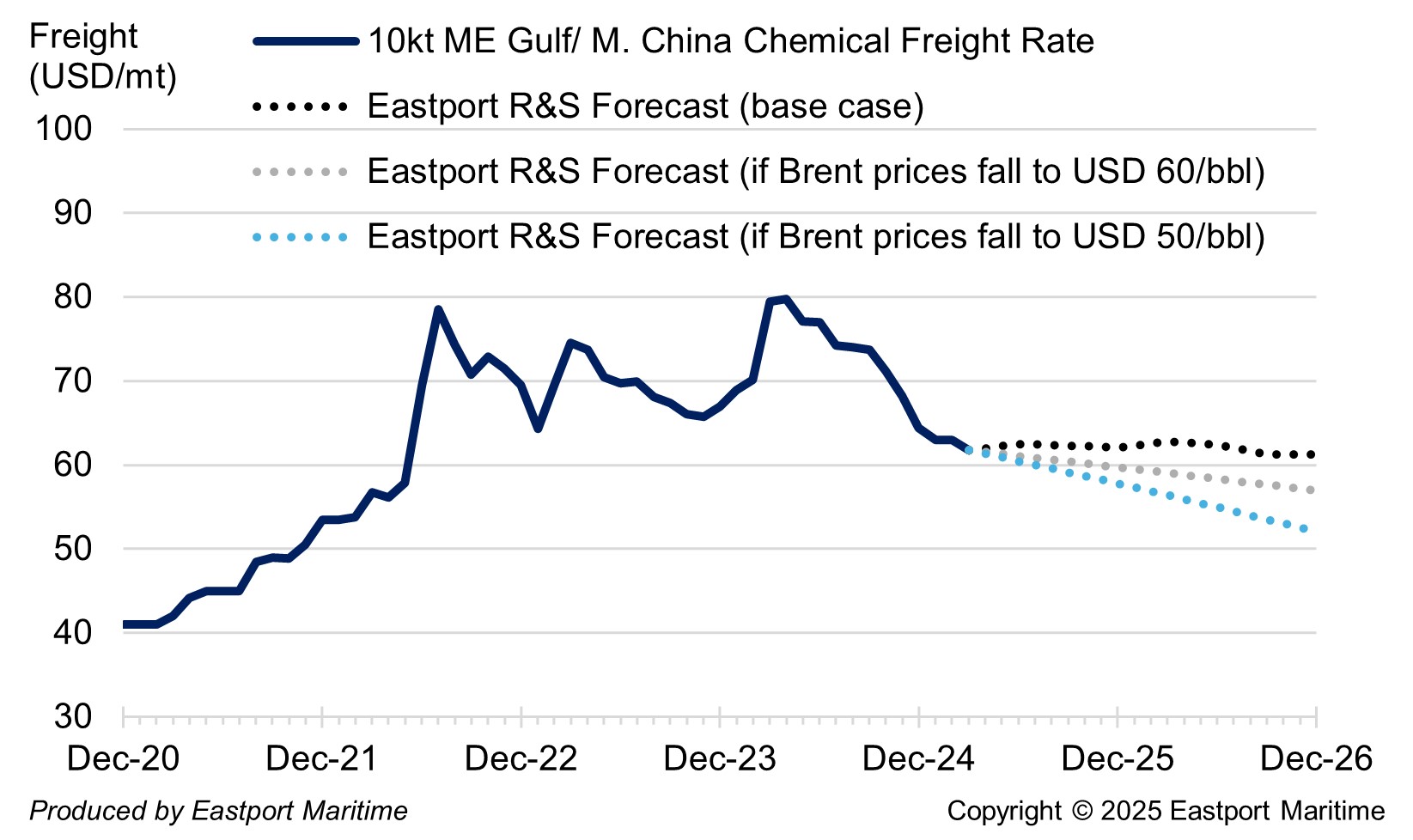

An impending trade war is raising alarm on Wall Street and prompting economists to revise downward economic growth projections. JPMorgan has assessed the risk of a global recession at 60% if the recently announced Trump tariffs stay in place (Bloomberg Finance LP). Slowing economic growth would likely ease demand for energy products and result in downward pressure on oil prices. Long-haul freights are most sensitive to changes in crude prices because bunker consumption is higher on such routes. The correlation between 10kt ME Gulf/NE Asia chemical freights is about 0.53 over the last 20 years. Against a backdrop of a widely expected slowdown in global growth, we ran a sensitivity analysis of 10kt ME Gulf/NE Asia chemical freights to assess the impact of different oil price scenarios for freights. The market rate for such parcels is currently USD 61/mt. The Bloomberg market consensus forecast for Brent in Q3 2026 was recently USD 69.50/bbl. At that level, our model suggests that 10kt MEG/NEA freights would stabilize at the current level through the end of 2026, our base case scenario. However, if oil falls to USD 60/bbl by that time, freights may end 2026 at around USD 57/mt. If oil ends the year at USD 50/bbl, then freights could decline to USD 52/mt.